Union Real estate loan are a domestic mortgage lender based in Kansas. Working during the forty eight claims together with District out-of Columbia, the firm offers some financing personal loans with bad credit circumstances. They might be fixed-speed and you may varying-speed mortgages, in addition to FHA, Virtual assistant, USDA, refinancing, rehabilitation, and the new construction finance.

While not yet , a nationwide mortgage company, Commitment Home loan really does operate in forty-two states. It is licensed to do business in all states except Hawaii and you can New york.

What type of Mortgage Do i need to Rating that have Union Mortgage loan?

Fixed-speed mortgage loans: Perhaps one of the most preferred form of mortgages, a fixed-speed mortgage features an appartment interest to the lifetime of the loan. Financing words at the Commitment Mortgage ranges from 10 so you’re able to 3 decades.

Adjustable-speed mortgages: Also referred to as Sleeve loans, adjustable-rate mortgage loans start with a fixed price prior to getting used to markets costs once an appartment period.

FHA finance: Insured by Government Housing Government, these types of special mortgages want a minimum step three% downpayment and might be much more available to individuals which have previous borrowing products.

Virtual assistant fund: Supported by new Service off Experienced Situations (VA), these funds are made to greatly help qualified military positives, veterans, and reservists pick property. No matter if individuals need to pay good Virtual assistant resource payment, most of the time banking institutions do not require a deposit for it form of from loan and can even promote a lowered rate of interest than which have a conventional mortgage device.

USDA funds: Considering merely inside designated rural areas, the Department from Farming (USDA) provides these types of money in order to maintain and refresh a whole lot more outlying components of the nation. Unique terms is given, for example 100% resource and higher flexibility to have individuals which have down or poorer borrowing ratings.

So what can You are doing On the web that have Commitment Real estate loan?

Partnership Home mortgage has the benefit of simple mortgage and you will refinancing calculators to assist you estimate your monthly installments before you apply. The web based hand calculators can also help you break apart the borrowed funds money for easy wisdom, in addition to have shown exactly how much you could help save that have good refinanced financial in the a lesser interest.

You simply cannot apply in person having a home loan online which have Connection Home Home loan, even if you is also take control of your mortgage thanks to the customer site. Questions on line try easy and simple, nevertheless need submit a form otherwise telephone call directly to speak with a loan officer so you’re able to apply.

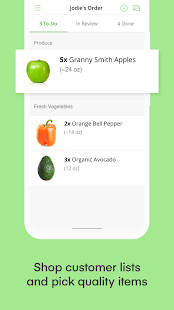

not, you could potentially apply for financing through the My personal UHM app. Possible individuals is also publish all of the documents necessary to the fresh app, tune its loan requests, and you will estimate payments using their cell phones. In case there are people situations, the business provides a phone number and current email address for further assist.

Can you Qualify for a mortgage Regarding Union Home mortgage?

Like any almost every other mortgage lender, Partnership Home loan dont reject a property financing only on account of a good borrower’s credit history. Extremely loan providers, yet not, do ask for a beneficial FICO rating of at least 620 having a normal financing, if you are particular bodies-recognized apps accommodate individuals with reduced-than-reasonable borrowing from the bank. Other variables you to loan providers believe are the debt-to-earnings proportion as well as the affordability of wanted house.

Of many regulators-supported mortgages also require the debtor to expend an exclusive mortgage superior (PMI), because the commonly traditional finance with down money off below 20%. According to the financing equipment, certain certified buyers will most likely not need certainly to lay anything down whatsoever.

What’s the Process for finding a home loan That have Union Home mortgage?

You can either begin the process by doing the latest contact form on the web otherwise by applying in person through the My personal UHM app. Filling out the program often show you by way of a comparison out of mortgage choice therefore the standards must circulate the application give. According to Partnership Home webpages, you should buy prequalified within a few minutes.

A specialist have a tendency to appraise your home when your application could have been gotten and your provide has been acknowledged. Once your loan could have been canned and you may fully accepted, it could be underwritten plus closing will be booked.

How Connection Mortgage Compares

No matter if Relationship Home loan even offers numerous mortgage alternatives, they do not are employed in all of the county. Therefore while most individuals might discover a product or service that works well better because of their items, certain potential buyers merely do not have you to choice.

At exactly the same time, the organization does have a very simple-to-play with mobile application, that may appeal to customers who enjoy using the smartphone in order to would their funds. To own customers who prefer a very traditional, face-to-deal with telecommunications, Partnership Family likewise has branches nationwide which have mortgage officers offered during fundamental business hours.