South Dakota: The fresh Southern Dakota Houses Invention Expert even offers advance payment assistance owing to their Basic-big date Homebuyer system. The application brings out of step 3% to help you 5% into the down-payment advice owing to that loan which is 0% interest, due-on-deals or fulfillment, and no payments.

Tennessee: The fresh new Tennessee Homes Development Institution has the benefit of DPA using their Higher Solutions As well as system

Texas: The newest Texas Company from Casing and you will Area Situations also offers downpayment advice with the My personal First Colorado Domestic system. The application form will bring around 5% of the loan amount inside the deposit direction.

Utah: The latest Utah Property Company has its Advance payment Recommendations system. You happen to be able to acquire all minimum called for off percentage along with all otherwise a portion of the closing costs on a thirty-year repaired-price next home loan.

Vermont: The fresh new Vermont Construction Funds Agencies also offers DPA using their Help system. The application form brings doing $15,000 into the deposit advice.

Washington: The newest Arizona County Homes Funds Fee has the benefit of DPA with the House Advantage system. The application form provides as much as 4% of amount borrowed when you look at the down payment assistance.

Western Virginia: The west Virginia Property Advancement Finance also provides DPA using their Homeownership Program. The applying loans Holly Hill FL brings anywhere between $5,000 and you will $10,000 into the downpayment advice, according to system and purchase cost of the house.

Wyoming: The latest Wyoming Community Innovation Power now offers its Domestic Once more program. Wyoming will bring a minimal-attract down-payment financing all the way to $15,000.

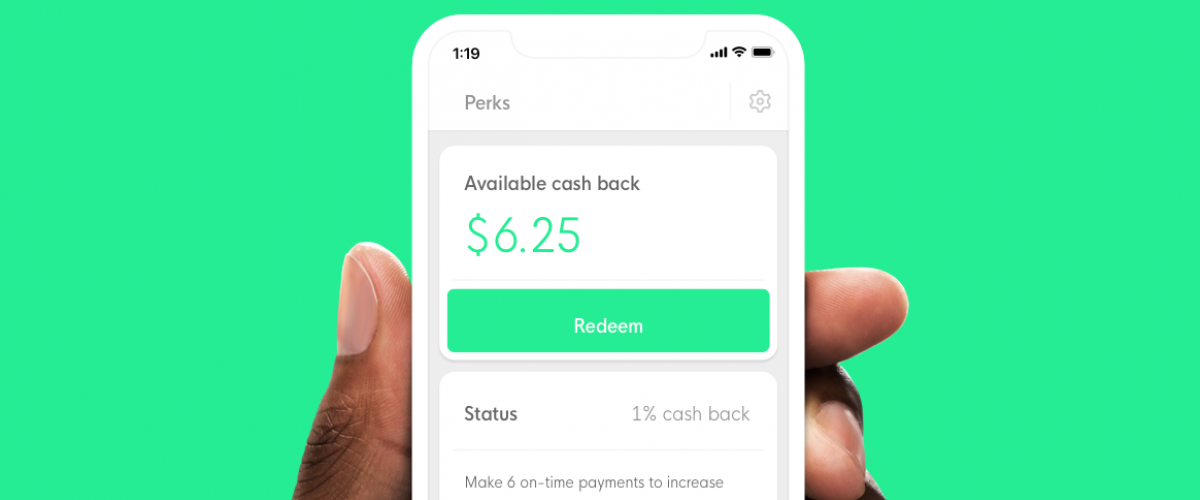

As well as these deposit guidance software on your regional field, Land to have Heroes helps firefighters, EMS, law enforcement, energetic army and you may veterans, medical care experts and you can educators; buy, offer and you may refinance their house or home loan. But if you manage their local a residential property and you can mortgage specialist to purchase, promote or refinance; nevertheless they promote tall deals when you intimate to your a house otherwise home loan. It relate to these types of savings because the Hero Perks savings, together with average amount gotten once closing on the a house is $step three,000, or $6,000 if you buy market!

The deals given by House having Heroes could well be at the same time for the DPA software you can be considered to receive. not, remember there are certain qualifications getting DPA apps which can feeling whether you could get the more Character Advantages coupons. How to read is to try to talk to an effective local Belongings to have Heroes pro.

Just join talk to a member of the group. There’s absolutely no obligations. After you sign-up they are going to get in touch with one to ask an effective pair questions that assist you determine the appropriate next tips to have your. Before you go, they will certainly connect you with the local a house and/otherwise financial experts in your area to assist you as a result of the action and you will save you money when it’s every complete.

Its how Property to own Heroes and their regional professionals give thanks to people heroes as if you, for the devoted and you may beneficial service.

The application form provides doing six% of your amount borrowed, otherwise $6,000, according to and that system you choose

This particular article are past current within the s change annually specific are going to be abandoned instead alerting Home getting Heroes. This is basically the finest guidance we’d when this was printed, and then we promise it includes belief regarding the prospective DPA programs for the your neighborhood. As usual, carry out their independent look and contact the new DPA program individually to determine in the event the this type of programs are a good fit for the demands.

The brand new Jersey Construction and you will Mortgage Funds Company (NJHMFA) also provides deposit assistance (DPA) regarding number of $ten,000 Otherwise $15,000, according to the county of the subject possessions. First generation consumers could possibly get located an extra $seven,000, to own an entire DPA prize regarding $17,000 so you’re able to $22,000. All of NJHMFA’s DPA programs need the means to access an NJHMFA first financial program, and you will DPA is offered as the next home loan with no attract otherwise payments, completely forgivable after 5 years. Qualifications limitations submit an application for both DPA and you may First generation Customer DPA honors and you will buyers need certainly to take care of the brand spanking new first-mortgage instead settling otherwise refinancing for five age toward DPA in order to feel forgiven. Get a hold of NJHMFA’s webpages for more information. Cops and you can Fire fighters who happen to be eligible people in new PFRS Your retirement program tends to be eligible for a 30-year first-mortgage that have rates rather less than market costs. The fresh new PFRS home loan product may not be in addition to the NJHMFA DPA.