When you start looking to purchase a house, you can easily tune in to about mortgage rates and just how far it sucks that they are rising, just how higher it is if they are dropping, or even as to why reasonable home loan cost are not usually a good material.

How do you can this fee? And just how does it really connect with how much you pay? With the reason for this short article, I’ll see how simply a 1% difference between the home loan rate can also be certainly affect exactly how much your pay.

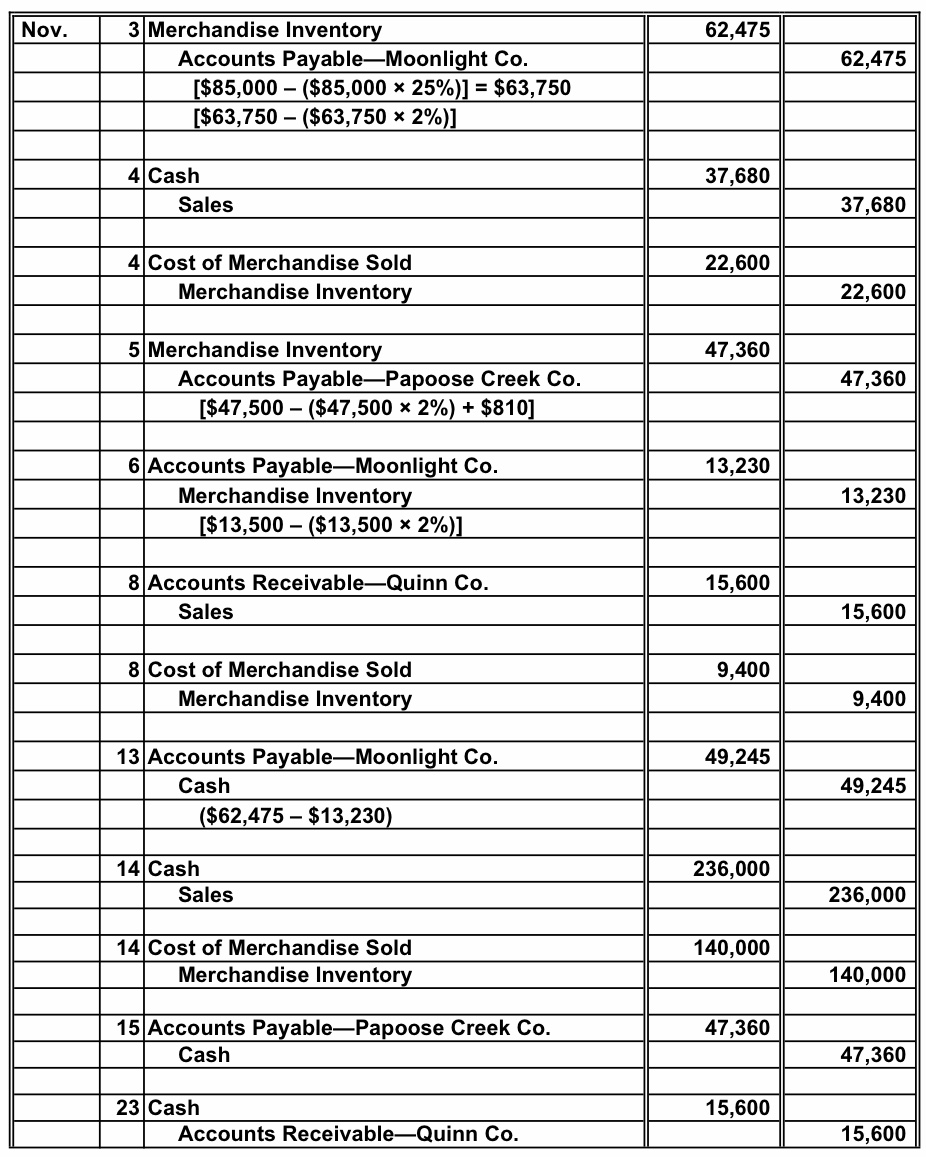

Since the you will observe on the table lower than, a-1% difference in a $200,000 house or apartment with a great $160,000 financial increases their payment from the nearly $100. As the difference between monthly payment may well not see you to high, the latest 1% high rate function you’ll be able to shell out whenever $29,000 even more within the desire across the 30-12 months identity. Ouch!

Just how home loan interest rates functions

Home financing is a type of financing used to get an effective domestic or other a property. The rate on home financing is the percentage of the overall loan amount that you will have to expend simultaneously toward principal, otherwise fresh, loan amount.

The speed towards the a home loan is normally conveyed as the an cash advance loans in Lynn CO apr, or Annual percentage rate. Thus you are going to need to pay-off the borrowed funds plus focus charges throughout the life span of the mortgage. The interest rate toward a mortgage should be repaired or varying, based their lender’s conditions and terms.

For those who have a predetermined-price mortgage, after that your interest rate will not change-over living from the loan. But when you have a varying-price home loan, this may be is change according to the Prime rate, eg.

How a-1% difference in mortgage price affects everything pay

Within analogy, let’s say you are searching to obtain a mortgage for $2 hundred,000. When you get a thirty-year home loan and you also create an excellent 20% deposit off $40,000, you will have an excellent $160,000 home loan.

If you simply set-out ten%, you have a $180,000 financial. Another desk shows you how much you are able to pay – one another a month as well as over living of your loan – in for each and every circumstances.

*Commission wide variety revealed do not become personal financial insurance coverage (PMI), which may be required towards money which have down repayments of smaller than 20%. The actual monthly payment is generally highest.

Which computation along with doesn’t come with assets fees, which will raise the pricing considerably if you live during the good high-income tax urban area.

Inside example, a 1% financial speed huge difference results in a payment per month that is alongside $100 large. However the actual huge difference is how far more you can pay in the interest over three decades…over $33,000! And only imagine, for people who lived in the brand new mid-eighties when the highest financial price are 18%, you will be spending thousands 1 month merely within the attention!

What exactly is currently going on in order to mortgage costs?

COVID-19 pushed home loan interest levels down seriously to list lows, dipping so you’re able to a mouth-dropping dos.67% within the . Regrettably, 30-12 months fixed home loan pricing has actually since ballooned to help you typically 8.48% since .

But don’t end up being as well bummed aside. Envision that back in the fresh new 80s, a routine home loan rate is actually ranging from 10% and you can 18%, and you may good 8.x% rates cannot look as well bad, comparatively. Of course, the cost of a home keeps grown subsequently, but mortgage rates are nevertheless drastically below they might end up being.

Getting a reduced mortgage rate

Sadly, you don’t need to many private control of this new average rates of interest offered by any given time. Nevertheless have a lot of command over the latest rates you will end up given according to the common.