In some cities today, a property was an excellent seller’s market. Having several buyers in line for example property, you might overlook the home of your dreams instead of financing preapproval in hand.

When you are farm and ranch a house selling age principles nonetheless implement. Performing pursuit before you apply getting financial support, you could potentially place oneself into the a primary updates to maneuver whenever suitable property becomes offered.

Start very early.

“The procedure for both the customers additionally the financing officer happens significantly more effortlessly when the information is bundled up-and over,” says Justin Wiethorn, Tx Land-bank local president. “In the event that a candidate are unable to get it during the, it adds an additional or third round out-of go after-upwards, and this waits vital processes and will getting frustrating for the buyers.”

Wiethorn claims he’s good proponent of obtaining preapprovals, and in some cases could possibly offer good preapproval which is a getting half a year. The guy plus uses this time to educate consumers who aren’t due to the fact always the loan processes with the various areas needed afterwards, such as for instance studies, title works and you can appraisals, so they really knows what to anticipate.

Details amount.

From inside the cases of prior delinquencies, be truthful. Extremely lenders say that lying otherwise withholding data is certainly one of more detrimental anything an applicant does. Factors is normally taken care of, very staying the mortgage administrator told throughout the very start can cut vital big date. This applies whenever getting a comprehensive description of your home to be had since the safety.

Understand your credit rating.

Amanda Simpson, secretary vice president which have Alabama Ranch Borrowing, describes an unfortunate scene this lady has seen play in their work environment over and over.

“I’ve had a prospective customer are located in pregnant the credit history is 100 points more than its, because they don’t realize a credit report is manage dozens of that time period after they was indeed vehicles shopping and allowed individuals buyers to get their rating, or a medical range appears due to an unpaid statement off age earlier that the applicant doesn’t have idea is present,” she says. “Inside our part, i generally speaking don’t pull a credit score up until we think there is a valid loan application – meaning i have a done financial statement, borrowing from the bank authorization or other recommendations depending on this consult.”

When you are actual down payment criteria may vary, he or she is usually based on borrowing from the bank factors assessed by bank. Wiethorn states the community fundamental to own residential fund was 20 per cent, and you may discovering you to definitely sum of money are an obstacle for the majority candidates. This is particularly true getting younger otherwise basic-big date individuals, or people who received mortgage loans which have quick off repayments during the the last few years and could enjoys a difficult time transitioning for the world standard.

“Ranch Credit comes with a loan program to possess more youthful, birth or small manufacturers, which includes less restrictive borrowing conditions to assist them to with the change to your agriculture or ranching,” Wiethorn claims. “This consists of downpayment conditions, including our power to work with external provide, such as the Farm Services Company. When you’re there are lots of constraints on the means to access this method, it has been good equipment to simply help certain more youthful possible borrowers through its basic home pick.”

Find out the “Five Cs out of Borrowing.”

- Character: the brand new borrower’s trustworthiness and you can stability

- Capacity: the brand new applicant’s monetary capability to repay the mortgage

- Capital: the new applicant’s liquidity and you may solvency

- Collateral: the latest actual assets that will prevent the newest lender’s exposure from the experience from standard

- Conditions: the standards to own giving and you can repaying the loan

“The fresh loans in Bon Air without credit checl ‘five Cs’ will keep you from trouble,” Kenneth Hooper, Panhandle-Plains Land-bank elder vice president/part director, states. “Farm Borrowing from the bank have constantly caught in it, and i also believe its one of the reasons our system keeps succeeded for more than 95 ages. It is old content, however it work.”

Get to know the financial.

Whether or not an applicant is looking for “approval” regarding a loan provider during a credit card applicatoin process, lenders really do should behave as a group into the candidate. Especially that have Ranch Borrowing from the bank lenders, Simpson says one since the Ranch Borrowing from the bank specializes in rural financing, she desires their own customers feeling they may be able call on their particular for a lot of concerns connected with the operations.

Hooper believes, and you can states that good mortgage administrator tend to set a lot out of works for the building an effective relationship which have customers.

“That loan officer cannot you should be anybody collecting files,” Hooper claims. “We desire for it to-be an extended-label dating, and would like to end up being of good use and as a lot of a reports origin that you could – now and down the road.”

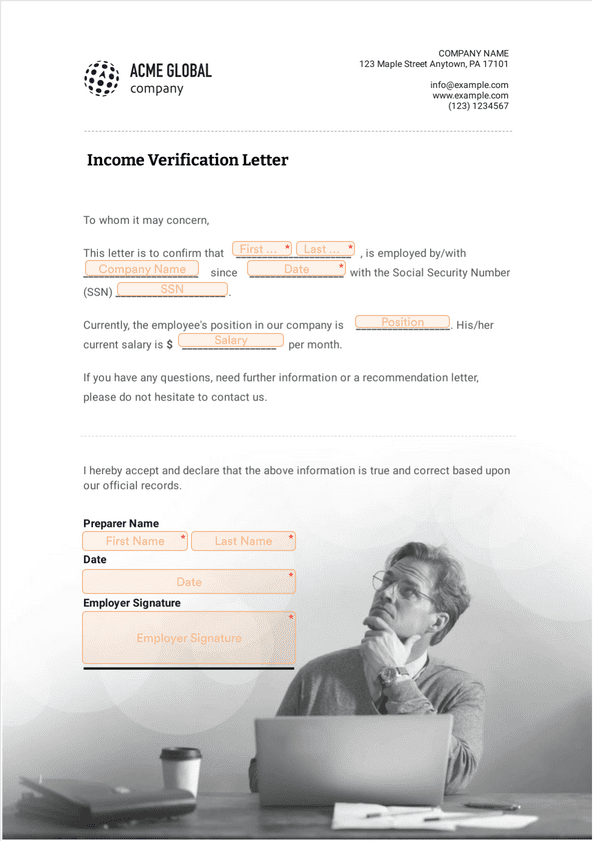

A document Record

Because variety of certain documents may differ away from financial to lender, all the mortgage officers will for the following:

Software and you may current statement of finance: This type of forms will be provided because of the bank. Separate economic comments might possibly be required for individual and you will relevant organizations eg partnerships or corporations where the candidate possess a keen attention.

Early in the day 36 months away from done taxation statements: Panhandle-Plains Land-bank Senior Vice-president/Department Manager Kenneth Hooper claims that the factor in 36 months out of efficiency (that’s practical having agricultural financing) is not to find a great age or bad years, but to track down manner into the money.

Legal breakdown out-of residential property given because shelter: Including an action otherwise questionnaire, followed by an enthusiastic aerial photo or a surveyor’s plat. In case the offered safeguards is actually a rural home, a good surveyor’s plat must be given.

Offers and borrowing from the bank recommendations: The financial institution will need copies of all the bank statements, certificates out of deposit, shared money, brings, securities, an such like., for each applicant.

Authorization function: It authorizes the lending company to acquire credit reports; work and you may earnings verifications; information linked to possessions, debts otherwise insurance rates; and every other suggestions necessary to complete the app.

Build records: A credit card applicatoin having a property mortgage need to is a whole set away from preparations and specifications otherwise a copy of your own framework bid otherwise bargain closed by candidate while the creator.