One another refinancing and you will house security funds give you a means so you’re able to borrow secured on the fresh guarantee you have got collected along with your house. Once you always refinance, their dated financial try replaced by the a new that, will at the a lesser rate of interest. Concurrently, a property security mortgage was another financing that provides your dollars which is secure from the equity in your home.

Should you decide to remain in your residence to own from the minimum 2 yrs, you are able to thought refinancing to a lower life expectancy rates to reduce your month-to-month repayments. You may also re-finance to help you better up your loan amount against their house’s equity.

Guess you need a lump sum payment for a crisis or package to take care of particular fixes. In this case, you may take out the next mortgage otherwise family collateral loan to alter the latest equity you built up in your home into lent cash. emergency loans for bad credit This is exactly both the most popular station getting people going to bring away house renovations to improve the value of their home.

What’s the difference between an extra home loan and you will house collateral loan?

And also make anything crisper, the next mortgage and you may home equity mortgage tend to reference the latest same task. Property collateral loan is also entitled the next mortgage as they comes after the initial financial that was obtained to find the newest family.

Here are five what to help you discover a house equity loan better and just how it is different from a great refinanced home loan.

There are two style of home equity financing: a vintage domestic equity loan for which you acquire a lump sum and you can a house equity personal line of credit.

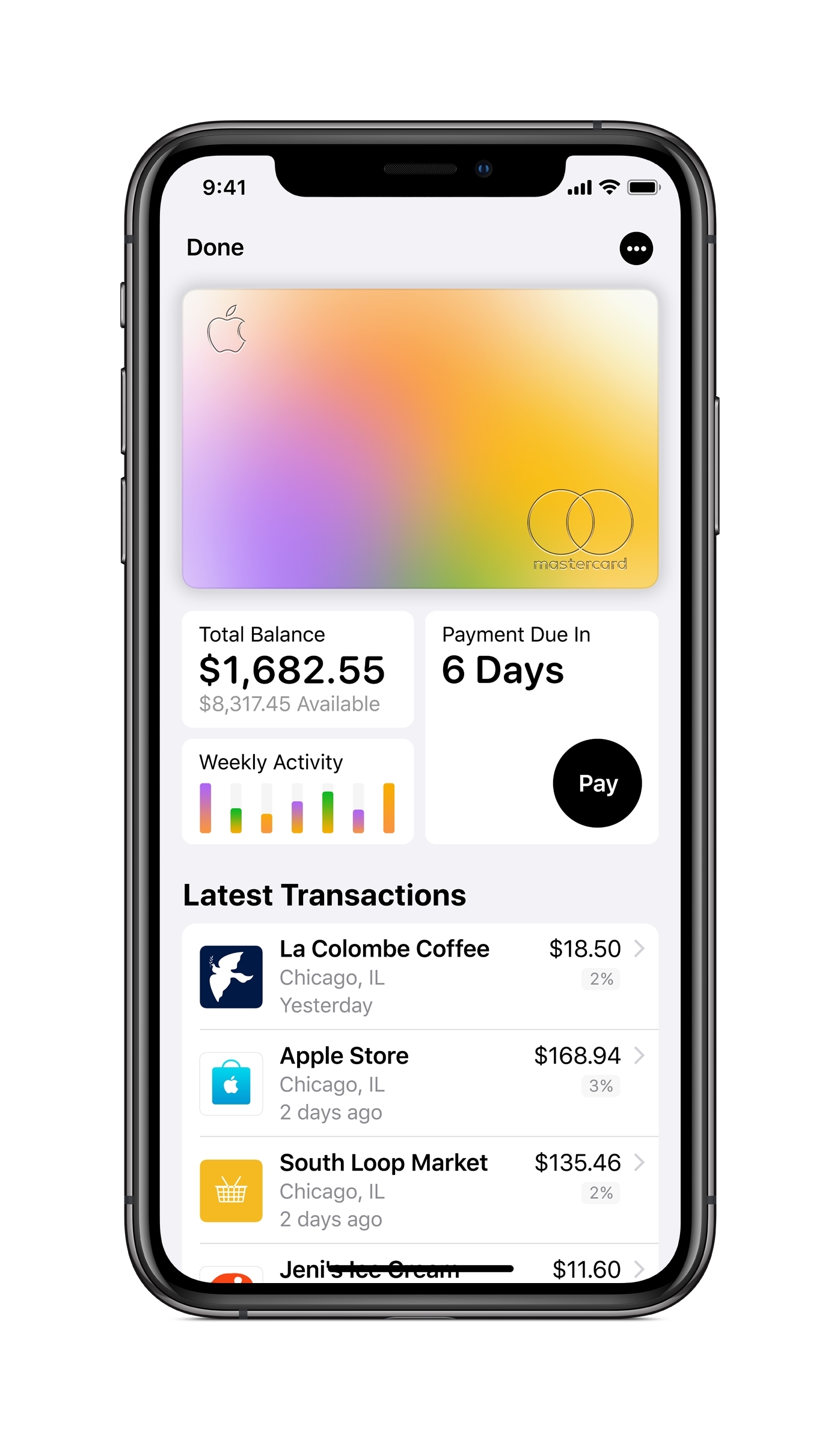

A property collateral line of credit will likely be know since a beneficial credit card that is linked with the newest security of your house. It means you could potentially borrow funds around the maximum borrowing limitation authorized by the bank, when you really need it, within a predetermined period referred to as drawdown months.

The benefit of a home security credit line is that you might use normally currency you desire in your recognized borrowing limit and also you pay just interest into the matter your provides borrowed on drawdown period. However,, the credit line closes because the drawdown several months stops and you also up coming need to begin paying off the main including attention.

At exactly the same time, when you refinance your own home loan, you usually alter your established mortgage having some other principal and you can attract loan, usually within a diminished rate of interest.

How do next mortgages and you may family security fund vary from refinancing?

That have a home guarantee credit line, you could potentially make attention-simply payments otherwise choose have your focus put in the financial equilibrium. Should you choose the second, you are going to reach finally your recognized limit earlier than for many who felt like while making desire-simply costs. Certain lenders will even enable it to be several costs, without the percentage, providing you way more flexibility within the dealing with your own funds.

Needless to say, like most almost every other mortgage tool, you still have to invest both prominent and you will attract parts of the borrowed funds shortly after a-flat time frame. Thus, even although you go for all the way down lowest monthly payments initially, repayments will have to be enhanced eventually. Spending precisely the restricted number for the majority of of the name can also be improve payment count most towards the end of one’s mortgage title.

Taking out fully property security personal line of credit can offer alot more autonomy in terms of repayments in comparison to a traditional dominating and you may attract home loan.

However the freedom could cost your extra regarding an excellent higher interest on your own drawdowns, in comparison to a beneficial refinanced financial.

You are able to spend a lower interest rate than what is frequently charged towards the an unsecured loan otherwise credit card debt, while the equity in your property backs your credit, but a higher level of interest than simply for people who refinanced.

Refinancing replaces your current mortgage with a brand new mortgage, and you also keep and then make monthly repayments such as for example before to invest off the main and you can notice slowly.

However, handling a line of credit demands certain a lot more monetary believed. Imagine youre merely make payment on focus from inside the drawdown months. In this case, you’d discover your monthly costs plunge most since the focus-simply several months is over. It has been best if you speak about your requirements having a large financial company to learn the risks and you can dangers on the one mortgage device.

Sooner, if or not you decide to re-finance their financial or take out an effective family collateral mortgage varies according to your very own activities. In either case, of many lenders simply allows you to borrow as much as 80 % of residence’s worth across the all of your funds except if youre noticed a low-exposure elite, such as for example a doctor otherwise allied healthcare specialist. You’ll be able to consult a brokerage to find out about special offers and you may discounts for the profession.